Millage rate calculator

Assessed Value Mill Rate 1000 - The assessed value is 70 percent of the appraised fair market value determined by the assessor. 2020 Millage Rates - A Complete List.

Tax Rate Calculator Flash Sales 57 Off Www Ingeniovirtual Com

Cars to calculate the benefit charge on free or subsidised fuel for private use the appropriate percentage used in.

. A millage rate is the tax rate used to calculate local property taxes. Millage Calculator If you need assistance using this tool please call 248-246-3201. How to Figure Tax.

Total city property tax revenue. A number of different. Property owners can use mills to calculate their property tax rate and total property tax amount.

2019 Millage Rates - A Complete List. The first number after the decimal point is tenths 1 the second number after the decimal point is hundredths 01 and going out three places is thousandths 001 or mills. Select your tax year.

Property taxes in Florida are implemented in millage rates. 2021 Millage Rates - A Complete List. Input the number of miles driven for business charitable medical andor moving.

The 2011 formula guarantees the rollback property tax millage rate will raise the same amount of property tax revenue in the new year as it did in the prior year. If the assessor determines that the. The assessed value 40 percent of the fair market value of a house that is worth 100000 is 40000.

Municipality Millage Code 2021 Millage Rate 2020 Millage Rate 2019 Millage Rate 2018 Millage Rate 2017 Millage Rate. The number you calculate millage multiplied by taxable value tells you the property taxes owed before any credits. Mileage calculator Enter your route details and price per mile and total up your distance and expenses.

You can improve your MPG with our eco-driving. Approved mileage rates from tax year 2011 to 2012 to present date. First determine the total number of mills in your local tax district.

You can calculate mileage reimbursement in three simple steps. A mileage allowance for using a privately owned vehicle POV for local TDY and PCS travel is reimbursed as a rate per mile in lieu of reimbursement of actual POV operating. IR-2022-124 June 9 2022 The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022.

2018 Millage Rates - A Complete List. It represents the number of dollars taxed per every 1000 of a propertys assessed value. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

Mileage Calculator Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States. Routes are automatically saved. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage.

In a county where the millage rate is 25 mills the property tax on. The millage rates would apply to that reduced number rather than the full.

Tax Rate Calculator Flash Sales 57 Off Www Ingeniovirtual Com

Property Taxes In Spain 9 Taxes You Have To Know

The Property Tax Equation

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

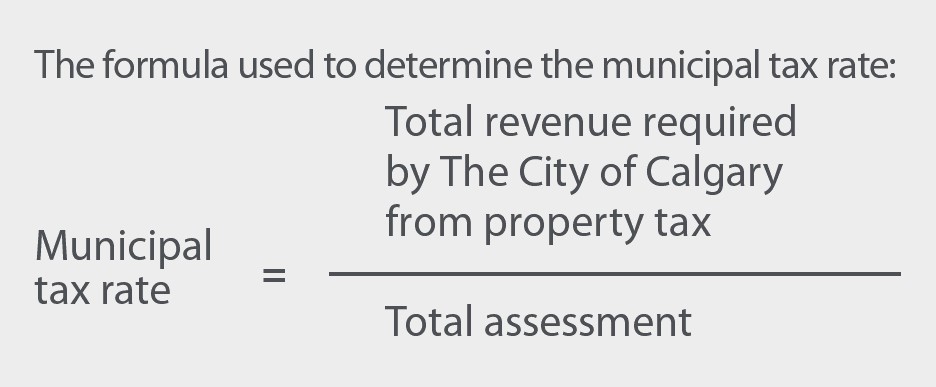

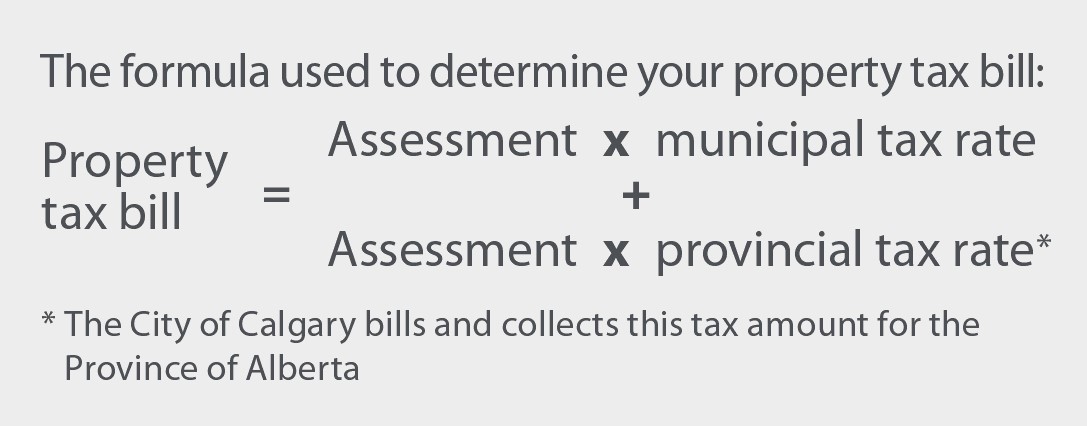

Property Tax Tax Rate And Bill Calculation

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Property Tax Tax Rate And Bill Calculation

Property Tax In The Netherlands

Property Tax Tax Rate And Bill Calculation

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

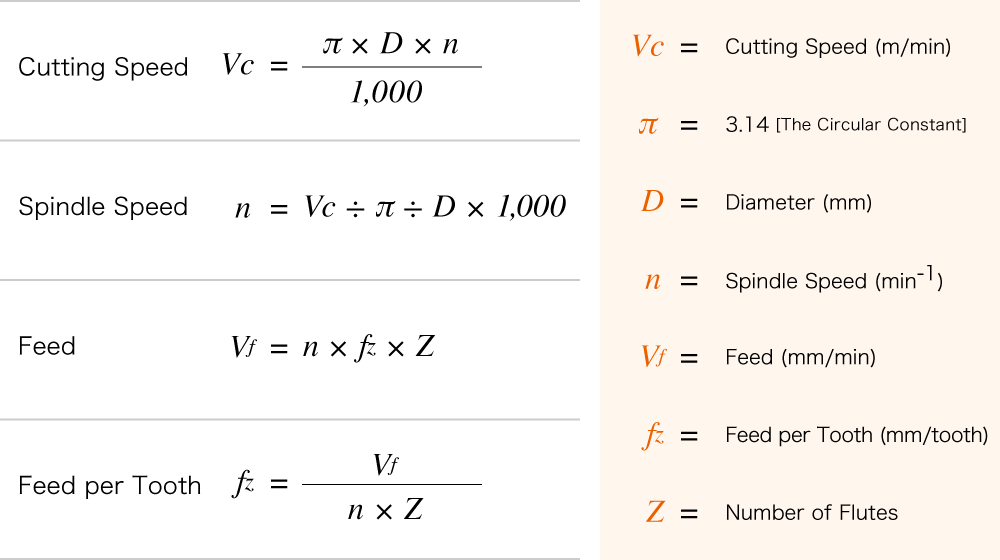

Calculation For Cutting Speed Spindle Speed And Feed Ns Tool Co Ltd

Property Tax How To Calculate Local Considerations

Millage Rates And Real Estate Property Taxes For Macomb County Michigan

Pennsylvania Property Tax Calculator Smartasset

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

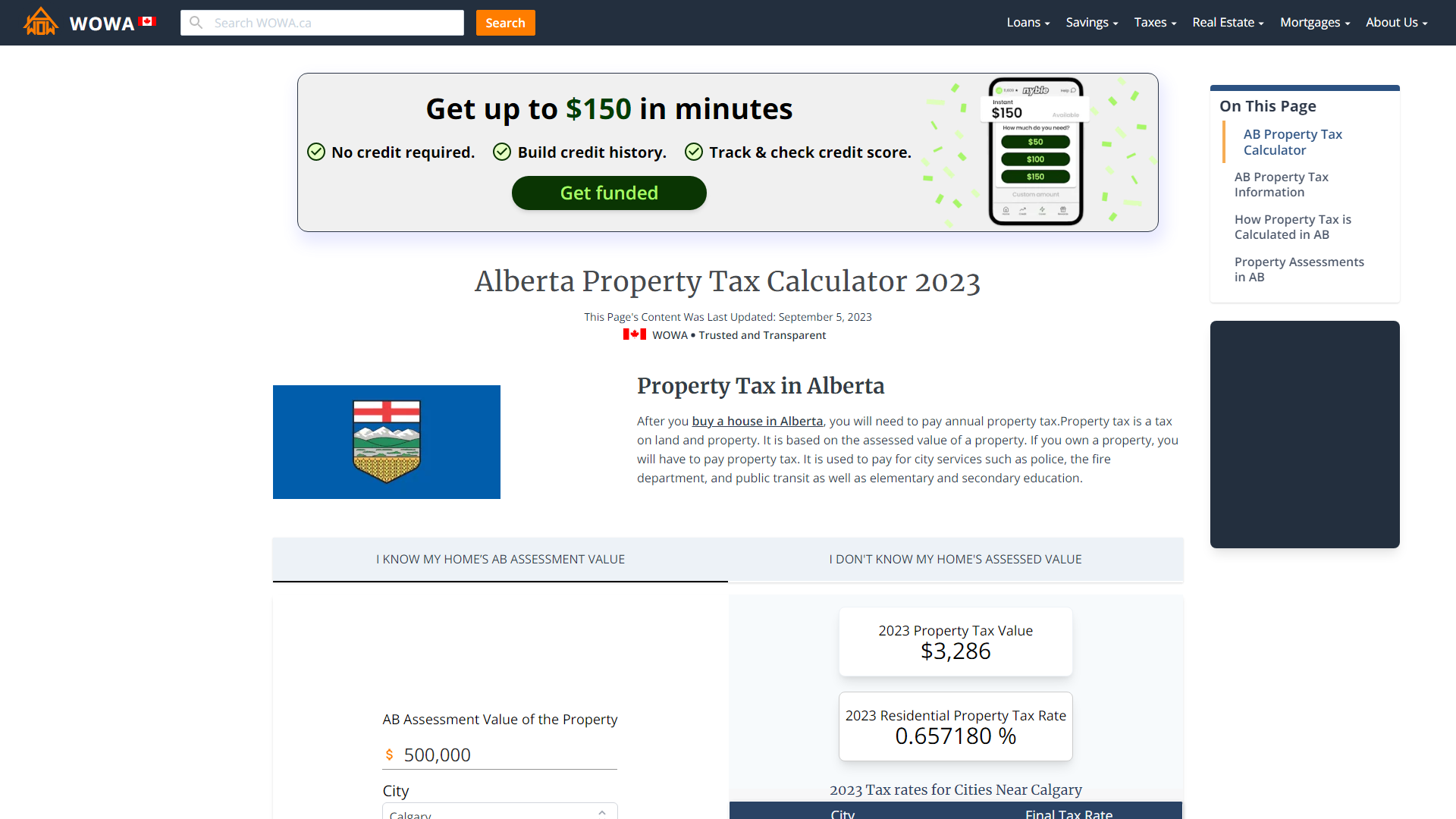

Alberta Property Tax Rates Calculator Wowa Ca