40+ is adjustable rate mortgage a good idea

Ad We Offer Competitive ARM Rates Fees. Web The introductory rate may last for as little as six months or as long as 10 years and it is often far lower than rates available on 30-year fixed-rate mortgage.

Adjustable Rate Mortgage 101 How They Work And Why They Can Be A Cheaper Option

Web Adjustable rate mortgages offer pros and cons.

. Web Say your initial ARM rate was 3 percent. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Adjustable-rate mortgage loans start with a fixed low interest rate for an introductory period.

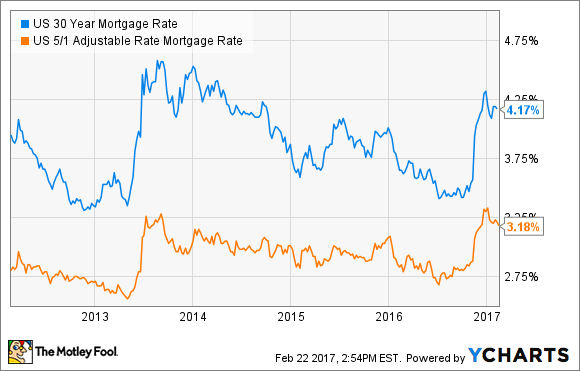

Web An ARM or Adjustable Rate Mortgage is a mortgage loan where the interest rate may change over the life of the loan. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The interest rate on a 30.

Lets say you have a 350000 loan and the interest rate is 60 percent fixed for 30 years. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The adjustable-rate mortgage commonly known as the ARM loan has an interest rate that will adjust or reset at a predetermined frequency every three years every five.

An ARM with a five-year introductory period after which the rate can change once a year. Ad 2023s Best Mortgage Rates Comparison. Were Americas 1 Online Lender.

Ultimately whether ARMs are a good deal for you depends on several factors including how long you plan to be in. Apply Easily Get Pre Approved In a Minute. Web Throughout 2022 mortgage interest rates steadily ticked upward in a march that priced many prospective homebuyers out of the market.

Web Is an Adjustable-Rate Mortgage ARM a Good Idea in 2022. Take Advantage And Lock In A Great Rate. Use NerdWallet Reviews To Research Lenders.

Web You can still get a low rate with an adjustable-rate mortgage even when rates rise. Choose The Loan That Suits You. Ad Get A Low Rate On Your ARM Today.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web 51 ARM. Get All The Info You Need To Choose a Mortgage Loan.

Your monthly mortgage payment would be about 2098 not including taxes and private mortgage insurance. Youll end up spending more with a 40-year fixed-rate mortgage even at a. Ad Compare Best Mortgage Lenders 2023.

Web The reason adjustable rate loans have a lower interest rate is that the bank or lender is passing on some of the risk of higher interest rates in the future to you the. Skip The Bank Save. An adjustable-rate mortgage can give you buying power you need.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Thats a fair question and a good one. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

ARMs are typically structured so the interest rate on the loan will remain fixed for an initial period of time and then adjust annually. Web Rates on a 40-year fixed are likely to be 025 percent to 0375 percent higher than on a traditional 30-year fixed-rate mortgage Cutts said. Web While an adjustable-rate mortgage may help you save money initially not all homeowners are willing to take on the additional risk that rates will rise during the life.

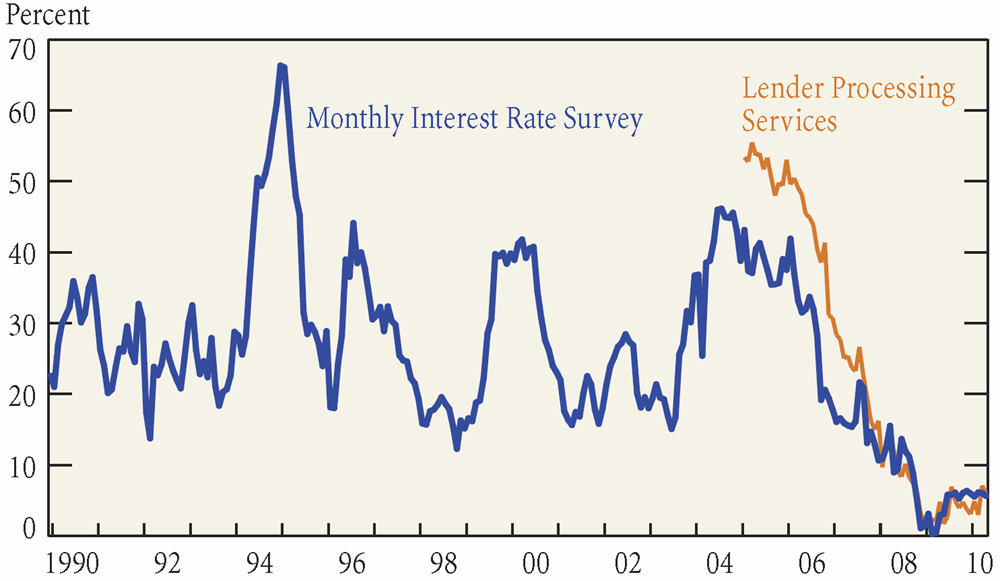

Web Adjustable-rate mortgages are gaining popularity because their relatively low introductory rates can give borrowers more homebuying power amid todays soaring home prices. Compare Adjustable Rate Mortgage Loans and Rates. As high as 7 at its second.

Apply Online Get Pre-Approved Today. Web Key Takeaways. Any mortgage is risky if it is matched with the wrong type of borrower.

With a rate cap structure of 225 your rate could increase up to 5 at its first adjustment. For example with a 51 ARM - the interest rate for the first 5 years would. Take Advantage And Lock In A Great Rate.

2 per-year rate change in. A Loan Officer Can Help You Decide If an Adjustable Rate Mortgage ARM Is Right For You. Use NerdWallet Reviews To Research Lenders.

Adjustable rate mortgages can be a good choice for borrowers who anticipate financing a property for a relatively short period of time say.

Should I Get An Adjustable Rate Mortgage Or Is It Too Risky Npr

:max_bytes(150000):strip_icc()/adjustable_rate_mortgage_what_happens_when_interest_rates_go_up-5bfc386b46e0fb00511d43c5.jpg)

Adjustable Rate Mortgage What Happens When Interest Rates Go Up

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

P Mortgages What Is A P Mortgage And Is It The Best Choice For Buying A Property Should I Choose P H Or Fixed Rate Mortgages When Buying A Property

Is It Time To Convert Your Variable Rate To Fixed Best Mortgage Broker Rates

Arm Loans American Mortgage Services Licensed In Many States

Should I Get An Adjustable Rate Mortgage Or Is It Too Risky Npr

Fixed Rate Vs Adjustable Rate Mortgage Which Is Right For You Twin Oaks Real Estate

Today S 20 Year Mortgage Rates Emerge As Best Money Saving Opportunity Feb 27 2023

Forget 30 Year Fixed Rate Mortgages Here S Why You Ll Save More Money With An Arm

15 Year Fixed Vs 30 Year Fixed The Pros And Cons

Fixed Rate Vs Adjustable Rate Mortgages

Considering An Adjustable Rate Mortgage Be Sure To Understand Risks

Arms Adjustable Rate Mortgages Good Idea Yes Or No

30 Year Vs 5 1 Arm Mortgage Which Should I Pick The Motley Fool

Adjustable Rate Mortgages The Pros And Cons Nerdwallet

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers